child tax credit payment schedule 2022

List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB. A payment of tax credits for the tax year 2022 to 2023.

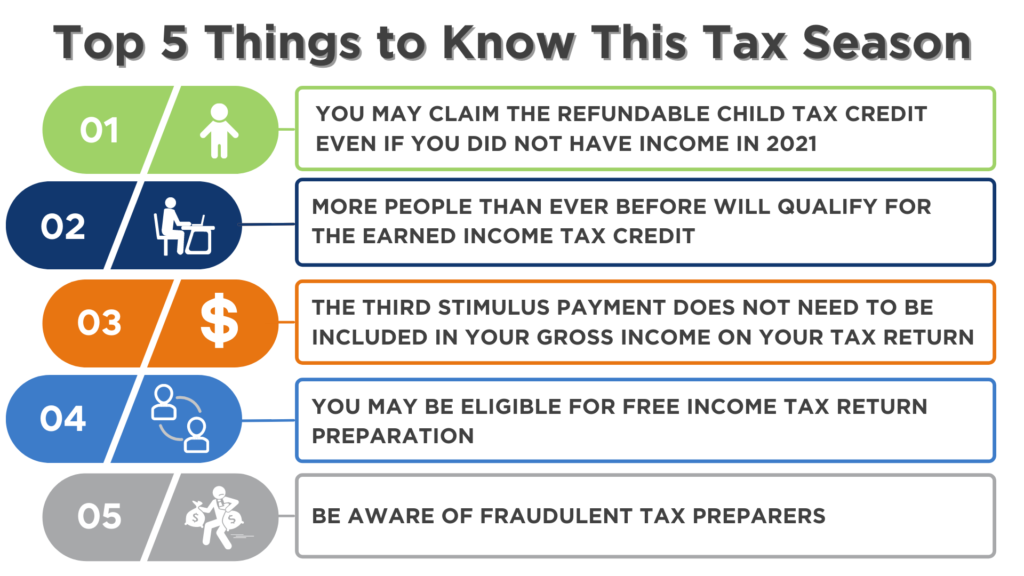

Child Tax Credit 2022 What We Know So Far

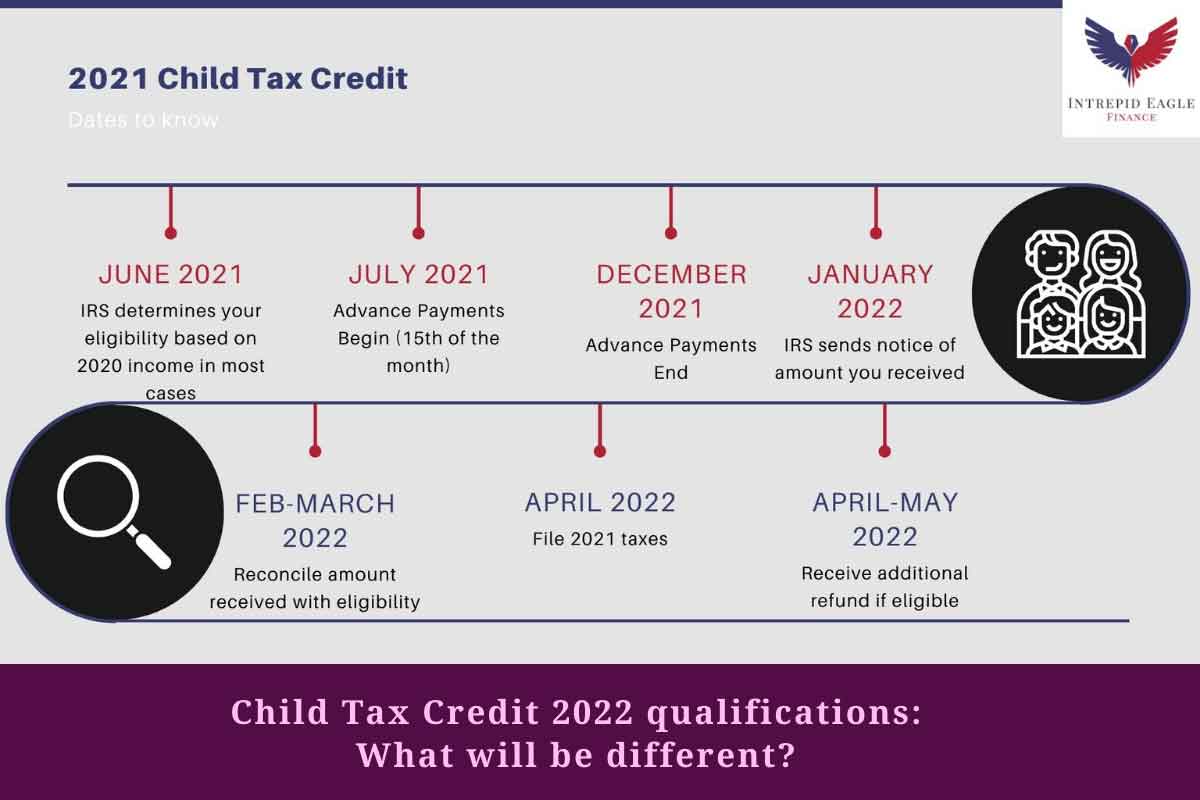

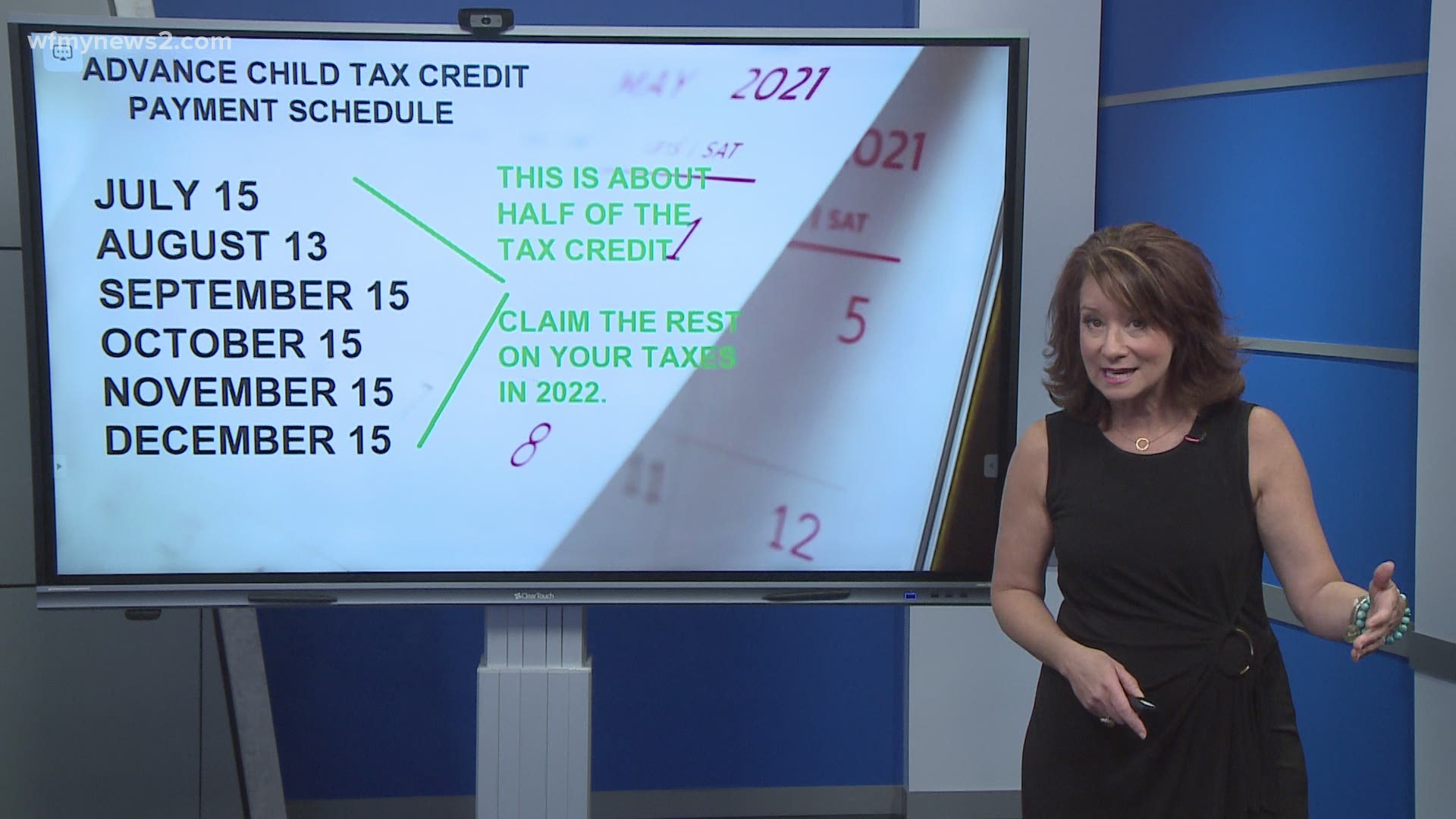

Families who received advance monthly child tax credit payments in 2021 for up to half the value of that credit still.

. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. 2022 Child Tax Credit Payment Schedule. The percentage depends on your income.

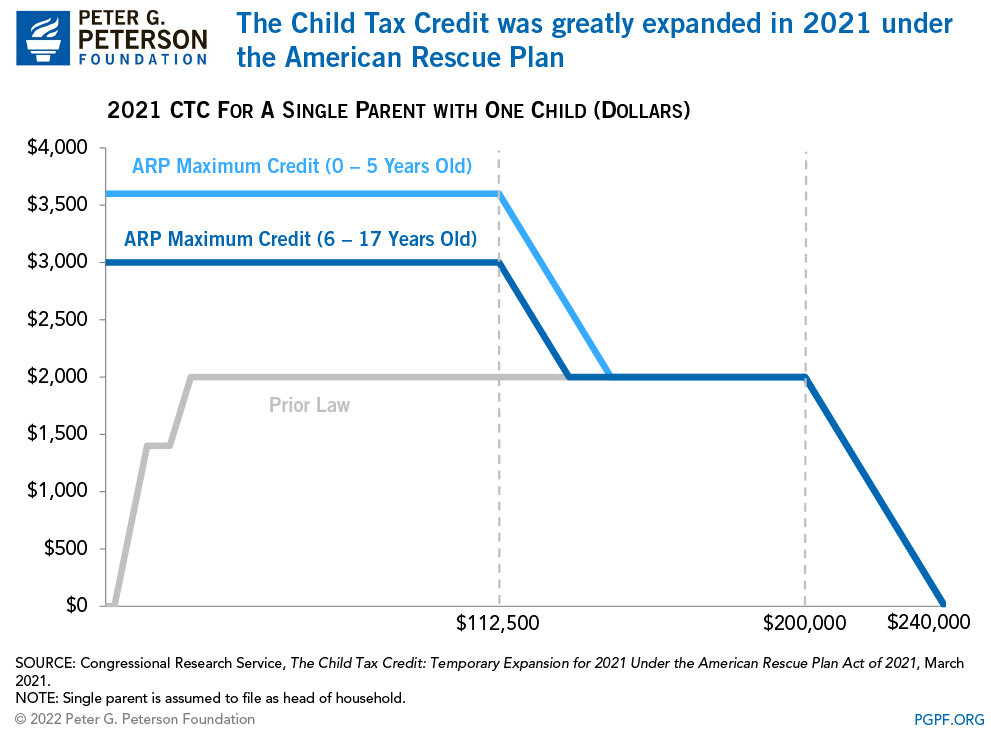

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. For example if you received advance Child Tax Credit payments for two qualifying children properly claimed on your 2020 tax return but you no longer have qualifying children in. Under the American Rescue Plans rules families with children 17 or younger were eligible for the full child tax credit.

Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains unknown. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month. Oct 17 2022 142 PM EDT.

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. The child tax credit has been the biggest helper to taxpayers with qualifying children under 18. The amount of the credit is smaller and eligibility is.

The Empire child tax credit in New. What are advance Child Tax Credit payments. You can get financial support to help with the costs of your childs tutoring supplies or equipment during the 202223 school year.

What is the child tax credit. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Stimulus check for advance child tax credit 2022 payments.

Child Tax Credit Payment. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments. Updated May 20 2022 A1.

How much is child tax credit for 2022. The payment for the. Live TV Schedule.

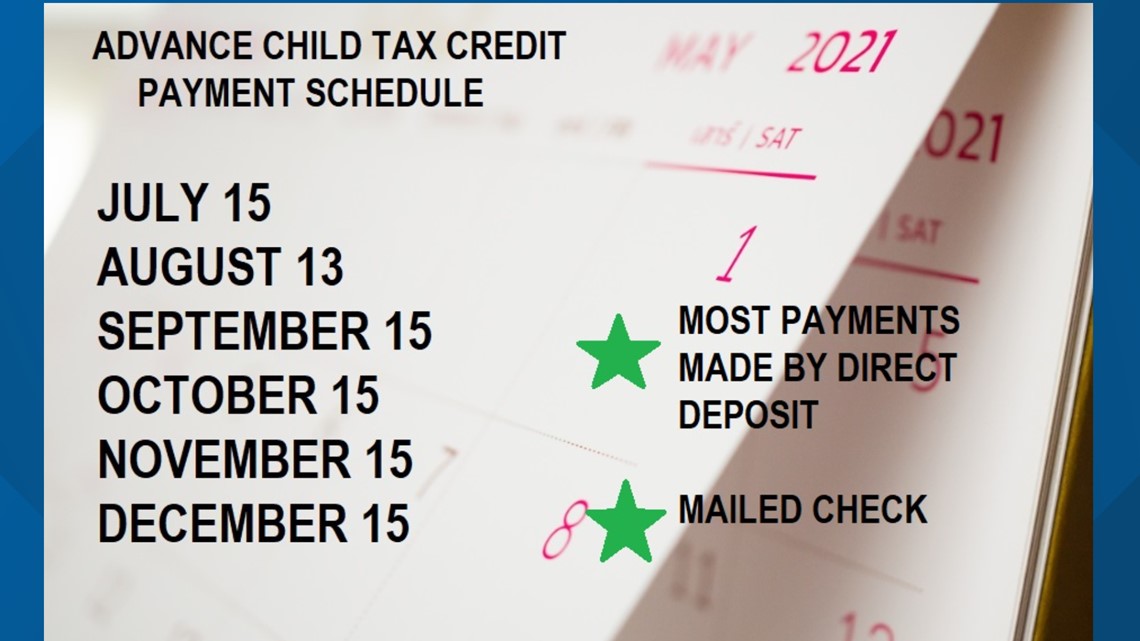

Child income tax credit 20. Within those returns are families who qualified for child tax credits CTC. The monthly payments started in July and ended in December with families receiving in cash up to half the credits total value of 3600 per child under 6 and 3000 per.

Freeyearbooksyarncouk For the first. MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Families could be eligible to.

Meaning in 2021 18 was the cutoff for CTC eligibility. As part of the American Rescue Act signed into law by President Joe Biden in. The maximum child tax credit amount will decrease in 2022.

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the. 2 days agoAbout Catch Up Payments. Child Tax Credit Payment Schedule 2022.

The advanced payments of the credit will continue in 2022 as. Explore updated credits deductions and exemptions including the standard deduction. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Parents Guide To The Child Tax Credit Nextadvisor With Time

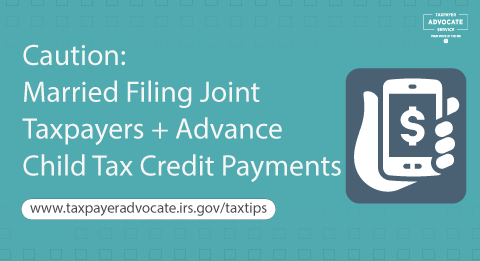

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

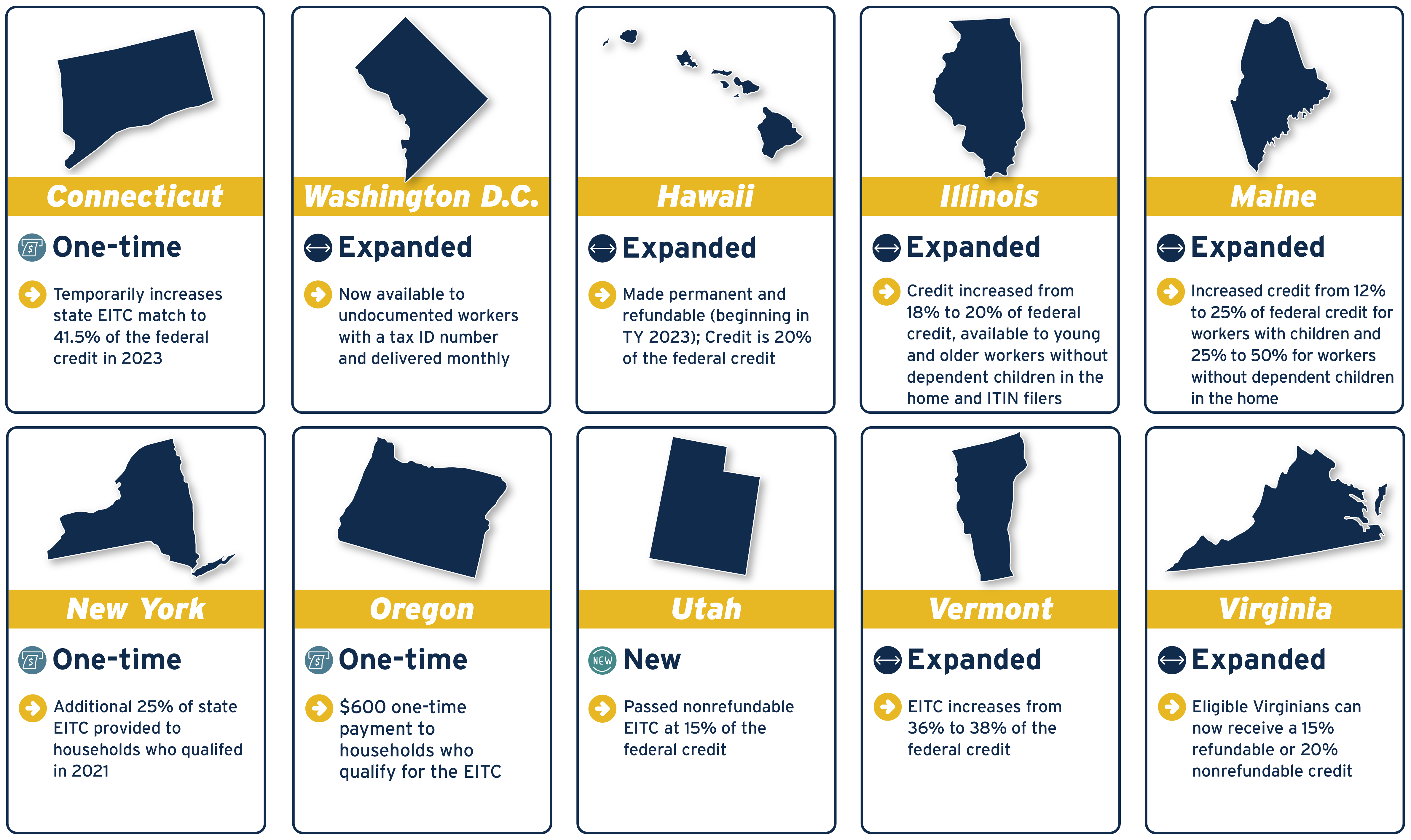

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022 Fox Business

Clearing Up Confusion Surrounding Changes To Child Tax Credit

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Will You Have To Repay The Advanced Child Tax Credit Payments

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

4 News Now Q A What Should Parents Know About The New Child Tax Credit Kxly

Child Tax Credit 2022 Why Build Back Better Vote Is Crucial Marca

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Newswire

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab